Despite urgent calls for climate action, including the European Union’s Green Deal and national industrial policies, public investment in the green transition has not reached the required levels. This research brief reveals a significant disparity between the stated goals of governments and the actual prioritization of green objectives within public investment.

Amid recognition of a major market failure, there is increasing agreement among academics and policymakers on the need for fresh thinking that supports a strong role for the state in climate policy (Aiginger & Rodrik, 2020; Mazzucato 2011). However, despite urgent calls to “ramp up” efforts to achieve net-zero emissions by 2050, the European Union (EU) Green Deal and national industrial policy plans have fallen significantly short of the required investment to facilitate the green transition. The Institute for Climate Economics estimates that the European investment deficit amounted to €403 billion in 2022 (I4CE, 2024). Arguably, this shortfall primarily results from a deficiency in public investment. Why has critical green state investment lagged behind in Europe?

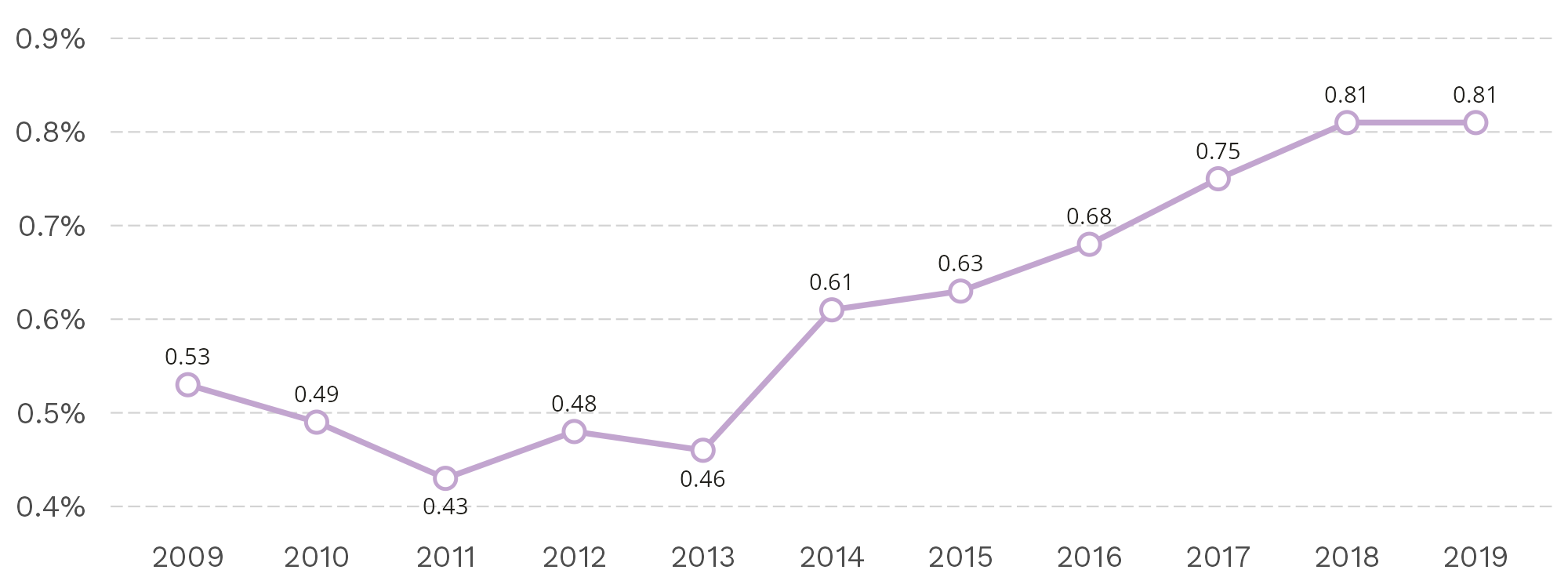

One explanation for this shortfall lies in fiscal austerity. Although the Maastricht criteria, specifying reference values of 3% of GDP for the government deficit and 60% of GDP for government debt criteria, were relaxed during the COVID pandemic, they have since been reinstated. Many fear that renewed calls for budgetary discipline will undermine efforts to achieve the green transition (Draghi, 2024). However, EU rules alone do not explain the lack of critical green investment in Europe. Indeed, European public investment has actually dramatically increased over the past two decades, including new discretionary investments. Figure 1 illustrates this trend, showing a steady increase in EU-authorized state aid to private firms, a pattern that began well before the pandemic. This increase in state investment implies that the

deficit in green public investment is not solely attributable to limits on spending, but rather, to the way governments prioritize spending among competing objectives, such as defence, strategic autonomy, national competitiveness or SME support. Understanding the green investment deficit requires moving beyond the supply of public investment to examine how state investment priorities are set.

Figure 1. evolution of state aids in the EU (share of GDP)

Figure: Alix d’Agostino, DeFacto · Data source: Eurostat

Allocation of public investment

Despite the critical importance of this question, there is no comprehensive study examining patterns of state investment across diverse priorities in Europe. The green finance literature, for instance, focuses exclusively on green investment (Darwas and Wolff, 2021). While this body of work offers valuable proposals for increasing green investment, it does not analyse how green objectives measure up against other priorities. Furthermore, it often overlooks the fact that, while the green transition is important, state actors view it as just one among many competing priorities.

Trade experts have recently begun compiling databases on state industrial policies, focusing on stated priorities (Evenett et al., 2024). Their findings reveal that climate mitigation has become a significant target of industrial policy measures. While regional variation exists, this emerging research shows that the increase in green-focused initiatives is modest compared to other priorities. Strategic competitiveness remains, by far, the most prominent focus of public investment. Moreover, the data used in these studies, and my own, relies on explicitly stated objectives, not accounting for “greenwashing” strategies. As a result, this work likely overestimates the share of public investment genuinely dedicated to the green transition.

To account for the share of green investment, my research adopts a more comprehensive approach that examining the full range of investment channels available to states within a given jurisdiction. This approach includes funds provided to national jurisdictions by the EU through the Recovery and Resilience Facility, state ownership and public contracts, as well as the entire spectrum of possible fiscal policies (Massoc, 2024). In so doing, I adopt a more thorough assessment of public investment, extending beyond the channels that typically capture media and public attention.

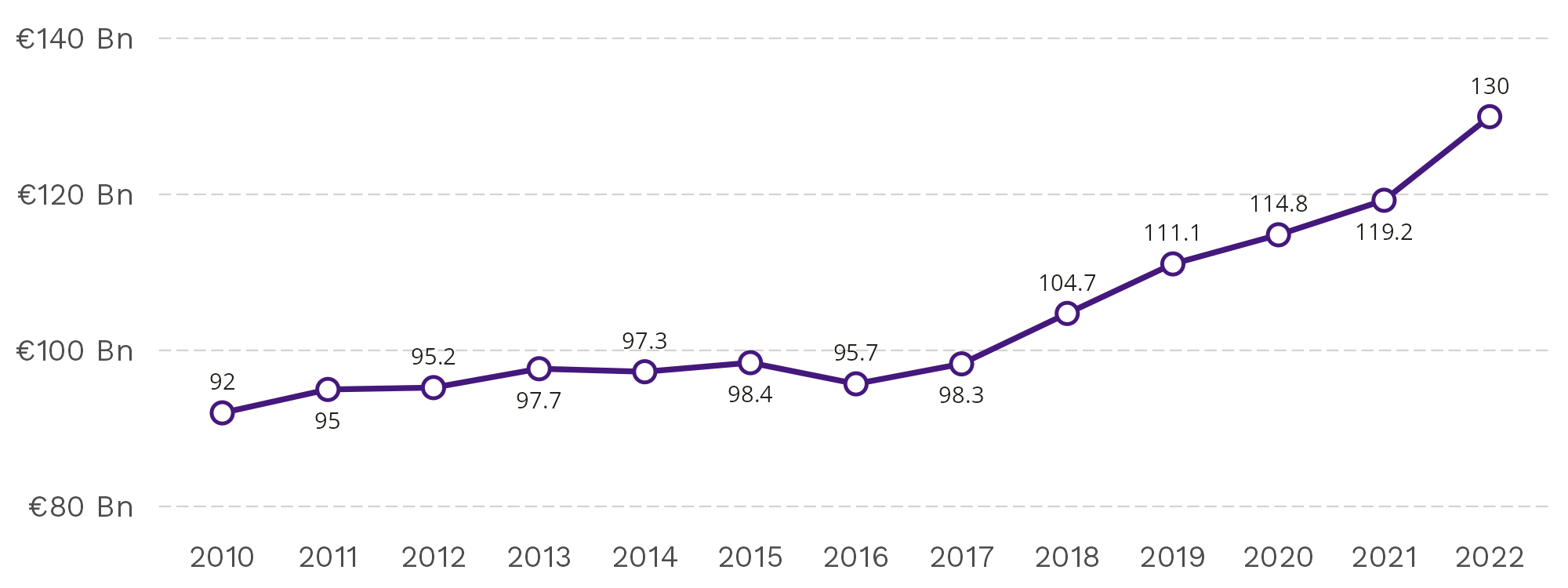

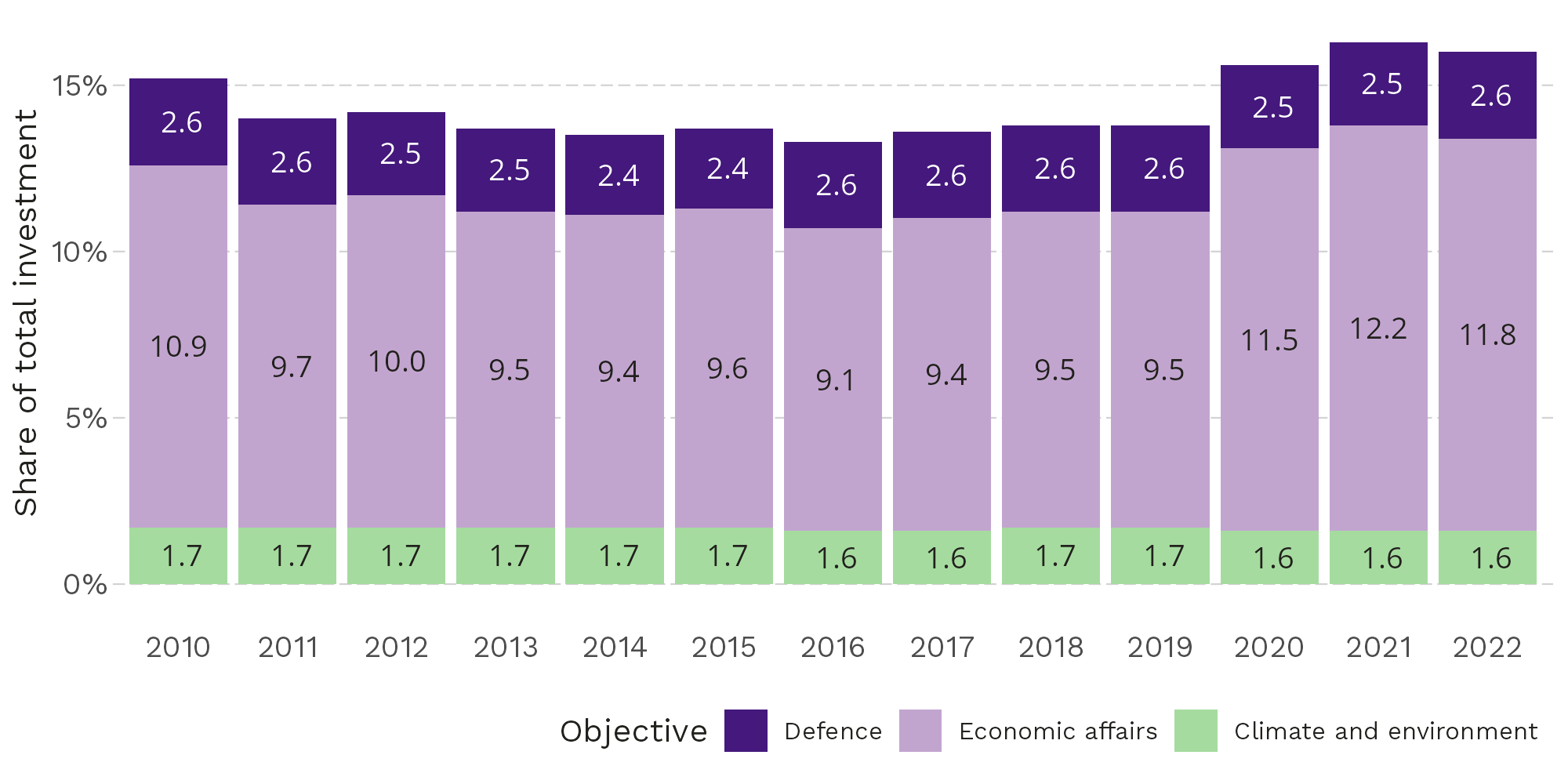

My findings reveal that, despite public discourse, green objectives are far from being a top priority. Figure 2 shows that government spending on climate and environmental initiatives, as measured by the EU, appears impressive—with a reported increase of over 40%. However, Figure 3 demonstrates that public investment in other priorities has increased by a similar, or even larger, magnitude. Indeed, the share of investment allocated to strategic competitiveness has grown more rapidly that green objectives. Consequently, government have been addressing climate and environmental objectives, it is clear that they have not been treated as the top priority.

Figure 2. Investment for climate and environment in the UE

Figure: Alix d’Agostino, DeFacto · Data source: Eurostat

Figure 3. Investment for different objectives the EU

Figure: Alix d’Agostino, DeFacto · Data source: Eurostat

Why do other public investment objectives often trump the green priority?

The first explanation that comes to mind concerns the political parties responsible for public investment decisions. Left-wing and green parties are typically expected to increase the share of public investment in areas like climate and environmental initiatives, prioritizing these over goals such as strategic competitiveness or defense. However, the evidence on this is mixed, suggesting that progressive parties do not significantly shift investment priorities when in power. Instead, their impact seems to be more pronounced through policy frameworks rather than direct changes in spending patterns (Cerqua et al., 2024).

Another explanation focuses on the lobbying efforts of the firms or sectors that stand to lose from an increased share of green investment, such as fossil fuel companies or industries heavily reliant on carbonintensive energy. Existing literature highlights that such lobbying is critical for shaping outcomes within specific policy areas (Guenther, 2024). However, a competing strand of research suggests that the high political salience of issues like the climate crisis can mitigate the effectiveness of lobbying strategies

employed by powerful firms (De Bruycker and Colli 2023).

My research suggests that the long-term patterns of state priorities in public investment are deeply rooted in the way institutions in Western democracies operate. My research shows that policymakers’ personal ties and connections with economic organizations shape their values, material interests, and, consequently, their preferences for investment allocation (Seabrooke and Stenström 2023).

Preliminary findings point to three key insights:

- While variation across countries exists, the majority of elected officials and bureaucrats in Europe maintain close ties to a narrow set of sectors, with finance and traditional industries dominating.

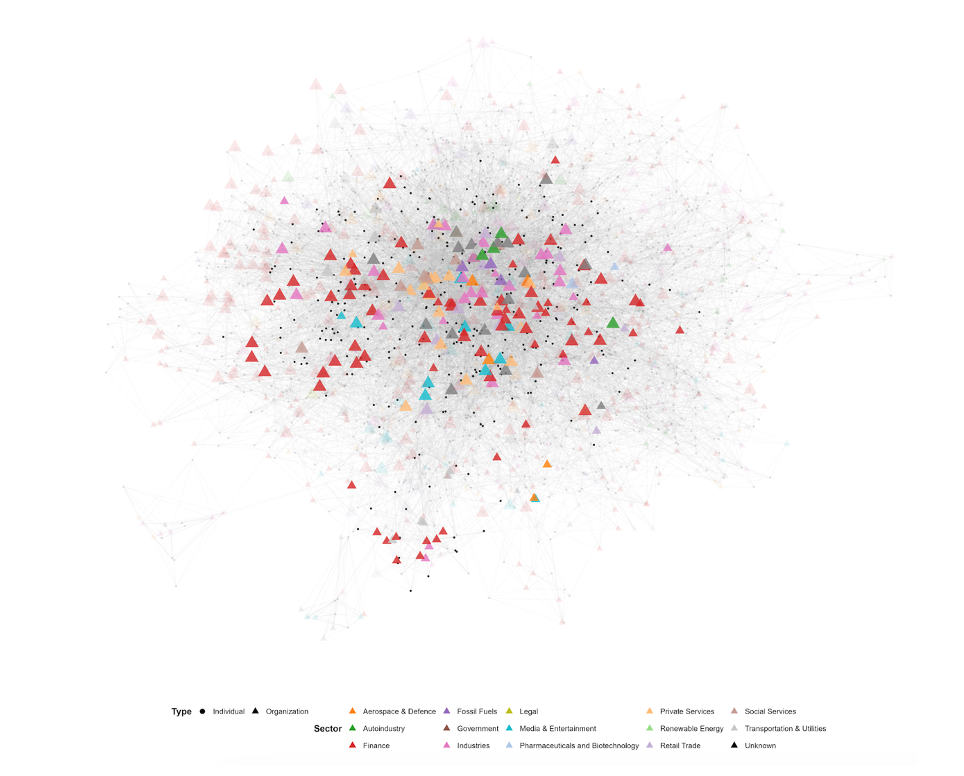

- The strength and nature of these connections differ across state institutions. For instance, ministry cabinet members tend to have more homogeneous profiles and are deeply tied to finance, consulting firms and traditional industries. Figure 4 presents a network analysis illustrating the career connections of French cabinets members (pictured as circles) with different sectors of the French economy (pictured as colored triangles). The dominance of individual connections with finance (red triangles) and traditional industries (pink triangles) appears clearly. Individual with connections with the automotiva industry (dark green) and fossil fuels industry (dark purple) are fewer, but appear at the centre of the network. By comparison, note the few connections with renewable energy sectors (light green). In contrast with this picture of the cabinet members, legislators in national parliaments exhibit greater diversity, with citizens’ councils showing the highest level of pluralism.

- State agents with strong economic ties are more likely to prioritize objectives such as strategic competitiveness over other goals, including the green transition.

Figure 4. network analysis of French cabinet members (all ministries, 2008-2023)

Figure: Massoc and Quesada Velazco (2024), based on biographic data of Cabinet members of all French Ministries (2000-2023) collected from BoardEx and Wikidata

State actors with deep connections to traditional industrial and financial sectors tend to be more responsive to non-green interests and preferences. These actors often operate with limited oversight in decision-making processes concerning state investments, resulting in the prioritization of non-green objectives and the consistent failure to meet critical green targets.

I conducted a preliminary comparative case study on the governance of state investment channels in France, drawing on 15 research interviews and document analysis. This study leveraged the rise of off-balance-sheet state investment channels, which are characterized by minimal checks on executive power and the strong economic ties of the Ministry of Finance and its cabinet members. These channels stand in contrast to those subject to oversight by institutions with fewer economic connections, such as regulated savings mechanisms, which are scrutinized by both parliamentary bodies and citizen groups (Massoc and Benoit, 2024). My findings suggest that when actors with less narrow and more diversified ties to industry and finance sectors exert more institutionalized oversight, state investment tends to align more closely with green prioritiess. For instance, while less than 5% of off-budget investments are directed toward green objectives, 10% of regulated savings investments are allocated to such goals, thanks in part to civil society organizations advocating for the responsible use of “citizens’ money” (Massoc & Quesada Velazco, 2024). Figure 5 illustrates a petition calling for the reallocation of regulated savings investments toward climate objectives.

Figure 5. Petition campaign to advocate the use of regulated savings for climate objectives

Source: 350.org

Source: 350.org

Policy lessons for progressive politics

Politicians and academics often frame the obstacles to effective climate action as a “winners vs. losers”

dynamic within the electorate, with those perceived as losers of the green transition hindering the adoption of climate policies. This has led some to argue that effective climate action must be isolated from democratic processes, with some even suggesting the need for a technocratic state capable of implementing unpopular climate measures, inspired by China’s approach. In contrast, and in line with another strand of literature suggesting that a majority of voters actually support more ambitious climate policies and concrete measures to reduce emissions (Abou-Chadi et al., 2024), this brief proposes an alternative path for progressive politics. It argues that institutional reforms should be pursued to empower citizens in the allocation of public funds. For instance, citizens’ councils should be given formal influence in decision-making processes concerning public investment, following the successful models established at the local governance level (Willis et al., 2022).

References

Abou-Chadi, T., Jansen, J., Kollberg, M., & Redeker, N. (2024). Debunking the Backlash-Uncovering European Voters’ Climate Preferences.

Aiginger K, Rodrik D. (2020). Rebirth of Industrial Policy and an Agenda for the Twenty-First Century. Journal of Industry, Competition and Trade.

Cerqua, A., Fiorino, N., & Galli, E. (2024). Do green parties affect local waste management

policies? Journal of Environmental Economics and Management, 128, 103056.

Darvas, Z. M., & Wolff, G. B. (2021). A green fiscal pact: climate investment in times of budget consolidation (No. 18/2021). Bruegel Policy Contribution.

De Bruycker, I., & Colli, F. (2023). Affluence, congruence, and lobbying success in EU climate policy. Journal of Public Policy, 43(3), 512-532.

Draghio, M. (2024). The Future of European Competitiveness. EU Commission Report (September).

Evenett, S., Jakubik, A., Martín, F., & Ruta, M. (2024). The return of industrial policy in data. The World Economy, 47(7), 2762-2788.

Guenther, G. (2024). The Language of Climate Politics: Fossil-fuel Propaganda and how to Fight it. Oxford

University Press.

I4CE. (2024). European Climate Investment Deficit report: An investment pathway for Europe’s future.

Institute for Climate Economics, available at https://www.i4ce.org/en/publication/european-climateinvestment-deficit-report-investment-pathway-europe-future.

Massoc, E. C. (2024). The Government of Green Industrial Policy in Democratic Capitalism : A socioeconomic study of state investment in Europe – A Research Agenda. Working paper available at https://www.researchgate.net/profile/Elsa-Massoc

Massoc, E. C., & Benoit, C. (2024). A tale of dualization: accounting for the partial marketization of

regulated savings in France. Review of International Political Economy, 31(3), 854-879.

Massoc, E. C. & Quesada Velazsco (2024). State-led investment and the Green Transition: The means but

the End? The case of France. Working paper available at https://www.researchgate.net/profile/Elsa-Massoc

Mazzucato, M. (2011). The Entrepreneurial State. London: Demos.

Seabrooke, L., & Stenström, A. (2023). Professional ecologies in European sustainable finance. Governance, 36(4), 1271-1292.

Willis, R., Curato, N., & Smith, G. (2022). Deliberative democracy and the climate crisis. Wiley Interdisciplinary Reviews: Climate Change, 13(2), e759.

Picture: unsplash.com

Note: this article has been edited by Robin Stähli, DeFacto.